Research has shown that fraud in organisations increases where the organisations operate in countries which are in a period of either economic crisis or where the country ranks high in the World Corruption Index.

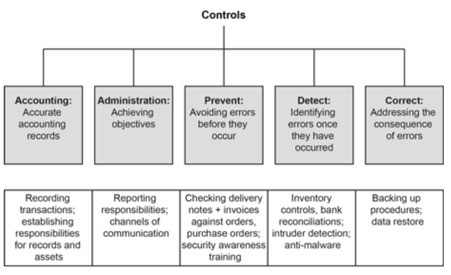

The role of internal audit is viewed as assisting management in safeguarding assets, monitoring control systems, preventing and detecting fraud, reviewing the 3E’s (economy, efficiency and effectiveness), identifying significant risks and ensuring completeness and accuracy of financial statements. Internal audit is changing rapidly in response to the changing needs of the organisation. The emphasis in many internal audit departments is to add value to the organisation and includes services ranging from providing expert advice on planning and risk management to information systems evaluation and advise on internal controls.

Internal auditors have become an integral part of modern day organisations as they are capable of detecting errors or misstatements which lead to fraud.

Good Corporate Governance now dictates some form of Internal Audit.

The CFOO Centre can assist you in:

Operational audits – which deal with the efficiency of the organisation’s activities;

Systems audits – that are used to test and evaluate controls and as to whether they can be relied upon and whether the information provided by the organisation’s systems is accurate;

In-depth audits – where Compliance tests would determine whether internal controls are being applied properly. Substantive tests would verify the accuracy of figures, used identify errors and omissions. Transactionary tests would be concerned with detecting fraud.

Your organisation does not need to employ an expensive and full-time resource.

With our Big 5 experience as well as over 50 years’ combined experience, we have detected numerous systems and process weaknesses and frauds. We have also undertaken numerous assignments as Internal Auditors for organisations in East Africa.