People are very familiar with the P&L Account and the Balance Sheet of the organisation which are prepared under IFRS. They are also aware of the Cash Flow Statements which are prepared under the indirect method. This reconcile net income to cash flows from operating activities.

One of the most important aspects of the organisation is the day to day cash. The organisation may be showing losses on its P&L Account whilst maintaining positive cash flows and life tends to hop along – at least in the short to medium term. But cash is like oxygen without which the organisation runs into a lot of trouble. Planning for cash is not difficult but many organisations fail to do exactly that.

Using ratio analysis to assess liquidity and cash is a good method but this looks into the past and does not provide insights into what the future holds in terms of cash in the organisation.

Surplus cash flows can be used for many purposes including redeeming expensive debt or other instruments or for investment purposes and most important of all for decision making purposes.

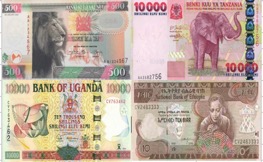

Cash flow forecasting is a managerial instrument that is used in good organisations. Liquidity management is based on short term cash flow forecasts whilst investments and financing decisions are based on long term forecasts. The importance of cash flow forecasting has been underlined by the difficult times many organisations in East Africa are facing. Reacting to cash flow issues is extremely costly (for example running to the banks for additional facilities or slowing down payments to creditors would lead to reputational loss as well as make the next purchase more expensive) and thus cash flow forecasting and management becomes one of the most important tasks. Whilst production, inventory and sales planning etc. are individual business functions, cash flow planning is an organisation wide activity that has to consider all transactions and payments. Reacting to cash flow problems is extremely costly and thus liquidity management becomes one of the most important tasks of the entire team. For cash flow forecasting, communication and cooperation between different organisational units plays the most important role for the efficiency and quality of the forecasts.

We prefer the direct method of cash flow forecasting and advise to base them on a 13-weekly forecast. The quality of cash flow forecasts is determined by the quality of the input data, the effort invested in forecasting, and the efficiency of the related processes. We believe in the philosophy that “action is better than reaction” and organisations must not react to cash flow problems but rather prepare for cash well in advance. We further advice organisations to undertake some form of cash flow sensitivity as well as a weekly forecast accuracy level.

Contact The CFOO Centre to help you in your cash flow forecasting. We can set up a once for all cash flow planning methodology for your organisation. Our methodology is not difficult nor is it complicated. It works with:

Cash flow basics,

Changing your leaderships culture on a cash based one,

Working capital and cash,

Designing cash flow into your systems from pricing decisions through to your investments,

Ensuring that you set up cash flows into your strategy.

www.cfoocentre.com